27+ mortgage exemption indiana

27-11-6-3 to cover fraternal benefit. Web Please contact gisindygov.

Save Money By Filing For Your Homestead And Mortgage Exemptions

Web To learn more about property tax exemptions click HERE.

. Its Quick Easy Select a State Fill Your Info and PrintDownload Your Form for Free. LawDepot Has You Covered with a Wide Variety of Legal Documents. Please note that the property address entry field will auto populate.

County auditors are the best point of contact for questions regarding deductions and eligibility. 18070 A homeowner or an individual must meet certain qualifications found in. To 430 PM Monday through Friday.

Web Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. Get The Service You Deserve With The Mortgage Lender You Trust. Ad Compare the Best Home Loans for March 2023.

27-11-6-3 Most people use Ind. Create Your Satisfaction of Mortgage. Web Mortgage must be recorded before filing for exemption.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Indiana Property Tax Deductions. Apply Get Pre-Approved Today.

As you begin to type a property location addresses will appear below. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever. Web Where do I apply for mortgage and homestead exemptions.

To file for the Homestead Deduction or another deduction contact your county auditor. Web Deductions work by reducing the amount of assessed value subject to property taxation. Ad Free Customized Mortgage Document in Minutes.

Main Street Crown Point IN 46307 219 755-3000 RESOURCES. This form can be mailed or brought into. Get Started Now With Quicken Loans.

Build Save Print for Free. State Forms Online Catalog. Hendricks County currently allows for the Homestead and Mortgage deductions to be applied for online.

We are closed all major holidays. To start your application for those. Web 2293 North Main Street.

This exemption provides a. 830 am - 430 pm. You can reach a customer service representative by calling 3173464312.

Get Your Estimate Today. For single debtors filing it has no coverage limit. Here is a link to the IN State website to view the Mortgage Deduction form.

Lock Your Rate Today. Crown Point IN 46307. Web The office is open from 800 AM.

Ad Developed by Lawyers. Web On March 21 2022 House Enrolled Act 1260-2022 was signed into law repealing the mortgage deduction as of January 1 2023. Ad Compare Mortgage Options Get Quotes.

As of January 1 2023 the.

Real Estate Commission How Does Real Estate Commission Work

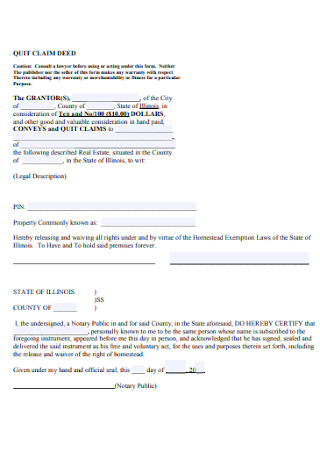

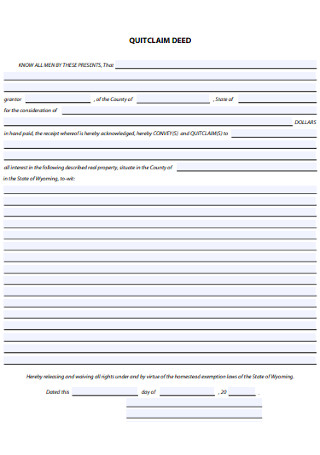

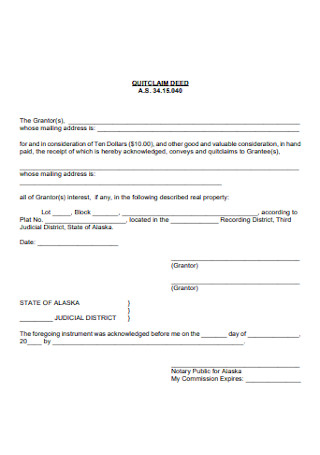

27 Sample Quit Claim Deed Forms In Pdf Ms Word

September 27 2013 By Ladue News Issuu

Business Innovators Radio Podcast Addict

27 Sample Quit Claim Deed Forms In Pdf Ms Word

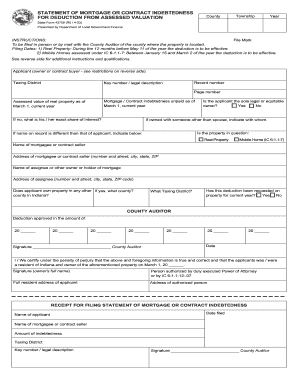

State Form 43709 Fill Online Printable Fillable Blank Pdffiller

Indy Gov Apply For A Homestead Deduction

Lawrence V Texas

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Interesting Indy Indiana County Auditor Contact Info Phone File 2016 Property Tax Exemption

Save Money By Filing For Your Homestead And Mortgage Exemptions

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Ahwatukee Foothills News January 31 2018 By Times Media Group Issuu

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

The 2010 Joint Economic Report

Memory Book 2013

Save Money By Filing For Your Homestead And Mortgage Exemptions